EUR/USD Slips Below Key Averages –

Is a Deeper Pullback on the Cards?

Tafara Tsoka

Chief Executive Officer: Zion Venture Partners

August 1, 2025

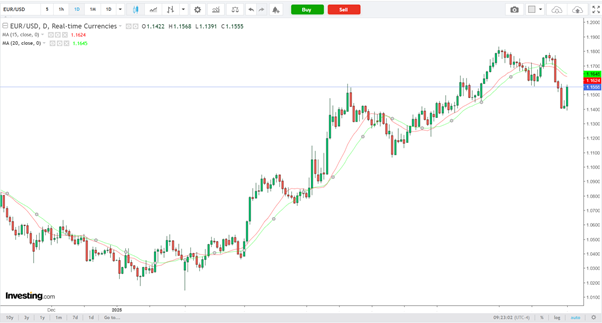

Source: Investing.com

EUR/USD is currently trading at 1.1555, following a sharp pullback from recent highs near 1.1900. The pair has broken below both the 15-day and 20-day moving averages, signalling a bearish shift in momentum. The moving averages have also begun to curve downward, further confirming short-term downside pressure.

The recent candle patterns show high volatility, with strong bearish candles dominating the last few sessions. This suggests that sellers are in control following a failed attempt to reclaim the 1.1700–1.1750 resistance zone.

Key Levels

- Immediate Resistance: 1.1620–1.1645 (15 & 20 moving average confluence)

- Next Resistance: 1.1700

- Immediate Support: 1.1390 (today’s low)

- Major Support Zone: 1.1300–1.1250

Bias: Bearish

A daily close below 1.1390 could open the door to a deeper correction toward the 1.1300–1.1250 support zone. To reverse the short-term bearish trend, the pair must reclaim the 1.1645 level and close convincingly above the moving averages.

Momentum is clearly tilted to the downside, and retail traders should watch for price action signals near 1.1390 for potential continuation or reversal plays. A bounce from this level could offer short-term relief, but until moving averages flatten or turn upward, the bearish bias remains intact.